In the fabrication department, laborers pour composite materials into custom carved molds. In finishing, the widgets are put on an automated production line where they are heated and coated. For example, Job 105 had revenue of USD 9,000 and costs of USD 5,500.Third, managers would compare actual overhead on the left side of the Overhead account, with the overhead applied to jobs on the right side. If the actual overhead exceeds the applied overhead, they may wish to learn why the actual overhead is so high.

Steps in job-order costing process

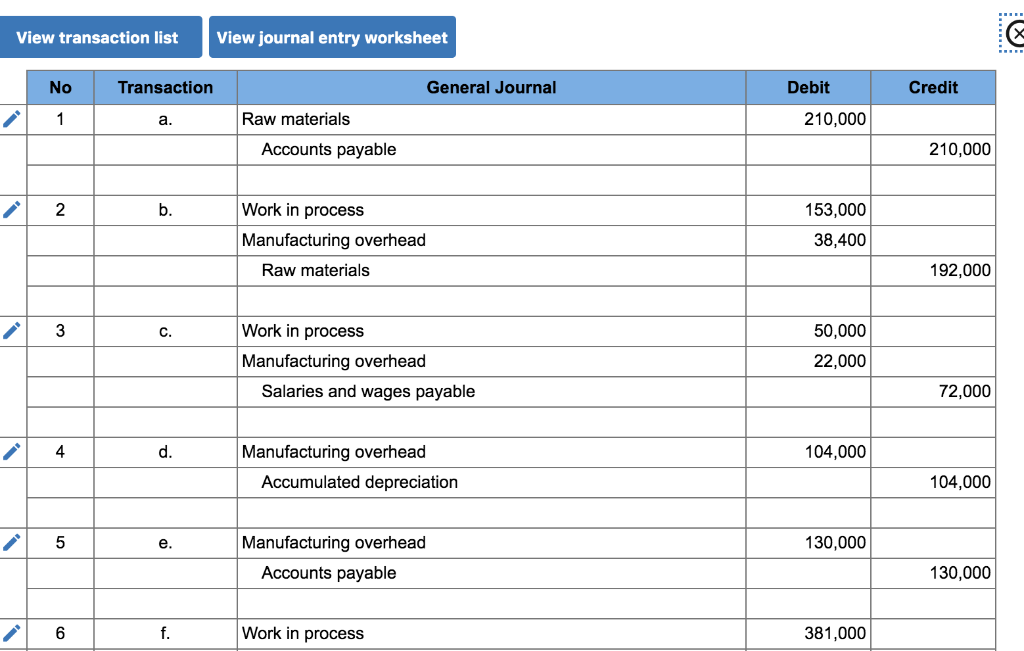

So, if the company actually worked 5000 machine hours, the estimated overhead costs would be $30,000. The three costs of production accumulate in an account called Work in Process, which is like the ‘tab” for the manufactured item. There are three debits to Work in Process – one for direct materials, one for direct labor, and one for factory overhead – as a result. The costs incurred during the manufacturing process are accumulated in inventory accounts within the organization’s accounting system.

3.1 Comprehensive Example of Job Order Costing Transactions for a Service Company

As with other subsidiary ledgers the business can choose whether this ledger or the work in process control account in the general ledger is part of the double entry bookkeeping system. Assume Creative Printers is a company run by agroup of students who use desktop publishing to produce specialtybooks and instruction manuals. Creative Printers uses job costing.Creative deciding when to file taxes this year depends on income changes Printers keeps track of the time and materials (mostlypaper) used on each job. The Moon Manufacturing Co. has a partial job order costing system instead of predetermining a factory overhead rate. This means that there is a $180,000 ($200,000 – $20,000) direct raw materials which we can assign directly to the specific jobs through work in process account.

Video Illustration 2-2: Computing an organization-wide predetermined manufacturing overhead rate LO3

Also, did you notice that actualoverhead came to $9,800 ($1,000 indirect materials + $2,000indirect labor + $6,800 other overhead from transaction g) but weapplied $9,850 in overhead to the jobs in transaction d? Wheneverwe use an estimate instead of actual numbers, it should be expectedthat an adjustment is needed. We will discuss the differencebetween actual and applied overhead and how we handle thedifferences in the next sections. One factor that can complicate the choice between job order costing and process costing is the growth of automation in the production process, which typically is accompanied by a reduction in direct labor.

- In some cases, organizations choose not to use a single, organization-wide predetermined manufacturing overhead rate to apply manufacturing overhead to the products or services produced.

- The journal entry to apply or assign overhead to the jobs would be to move the cost FROM overhead TO work in process inventory.

- In finishing, the widgets are put on an automated production line where they are heated and coated.

- The Raw Materials inventory account is used to record the costs for all raw materials—direct and indirect—purchased to manufacture a product.

Our mission is to empower readers with the most factual and reliable financial information possible to help them make informed decisions for their individual needs. We follow strict ethical journalism practices, which includes presenting unbiased information and citing reliable, attributed resources. At Finance Strategists, we partner with financial experts to ensure the accuracy of our financial content.

Job 17 had 4,050 machine-hours so overhead would be $8,100 (4,050 machine-hours x $2). The journal entry to apply or assign overhead to the jobs would be to move the cost FROM overhead TO work in process inventory. Where the cost allocation base refers to the estimated machine hours or estimated labor hours, depending on which one the company chooses to estimate its overhead costs by. The manufacturing overhead rate is a rate that allocates overhead costs to the production of a good or service based on an allocation formula. The company assigns overhead to each job onthe basis of the machine-hours each job uses.

This rate is used to charge the factory overhead to the jobs worked on during the month. The number of direct labor hours used on the jobs is the basis of such allocation. The accounting emphasis is in keeping records for the individual departments, which is useful for large batches or runs. Process costing is the optimal system to use when the production process is continuous and when it is difficult to trace a particular input cost to an individual product. Process costing systems assign costs to each department as the costs are incurred.

Compute the organization-wide predetermined manufacturing overhead rate using the template provided in Exhibit 2-4. Manufacturing overhead costs are applied to the jobs in process using a predetermined manufacturing overhead rate. The predetermined manufacturing overhead rate is discussed in detail in subsequent sections of this chapter. When manufacturing overhead is applied to the jobs in process, it is credited from the Manufacturing Overhead account and debited to the Work In Process account. The costs for direct labor is debited to the Work In Process inventory account and indirect labor is debited to the Manufacturing Overhead account.